EaseMyTrip - Pitti Airlines' Smooth Takeoff Hits Rough Skies

EaseMyTrip: A Detailed Analysis of Its Evolution, Challenges, and Strategic Outlook

EaseMyTrip reported a revenue decline in its latest quarter, capping a challenging year marked by several strategic misadventures. Over the past 12 months, the company’s promoters have ventured into unrelated pursuits, including launching an investment fund and attempting to revive the now-defunct GoAir airline. They also made premature announcements—such as suspending flight booking to Maldives and planning a hotel in Ayodhya—only to retract them later. It seems founders have reached a stage where core business expansion is not enough, they want to pursue many moonshots together, history isn’t kind to these kind of adventures.

Once hailed as a profitable bootstrapped startup, EaseMyTrip now grapples with tough times, with investor confidence hitting a low point.So lets try to analyse its past(good), present(murky) and future. We will examine EaseMyTrip’s journey, its current operational and financial challenges, its competitive positioning against MakeMyTrip(the market leader), the dynamics of the Indian OTA market, and its potential future trajectories, with a focus on detailed business analysis.

EaseMyTrip, founded in 2008 by the Pitti brothers—Nishant, Rikant, and Prashant—emerged from a modest garage in Delhi with a mission to simplify travel bookings in India. What began as a bootstrapped venture has grown into a significant player in the country’s online travel agency (OTA) market, securing a 10% market share by 2025.

From Bootstrap to Market Contender

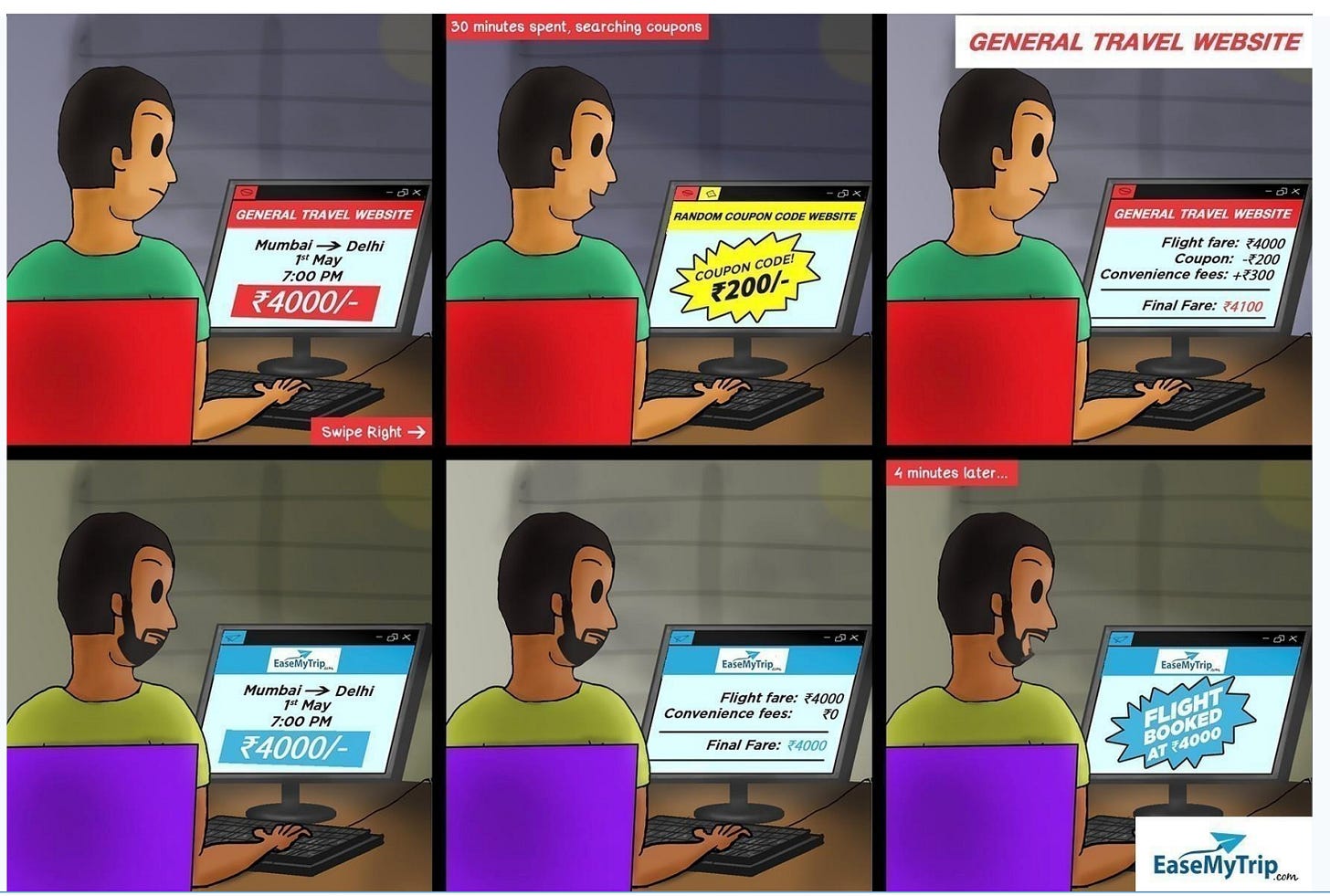

EaseMyTrip’s early success hinged on a distinctive business model tailored to India’s price-sensitive consumers. By eliminating convenience fees—a standard practice among OTAs—the company offered transparent pricing, complemented by a robust online platform and call-center support. This approach resonated with cost-conscious travelers, enabling EaseMyTrip to scale rapidly without external funding. By 2021, it had become India’s second-largest OTA and the only consistently profitable one, a rare feat in a sector often characterized by high customer acquisition costs and thin margins.

The company’s initial public offering (IPO) in March 2021 marked a pivotal moment. Oversubscribed 160 times, the IPO raised significant capital and signaled strong market confidence. However, the post-IPO trajectory has been less favorable. Over the past two years, EaseMyTrip’s stock has declined by 52%, reflecting investor concerns over its ability to sustain growth amid shifting market conditions and internal strategic decisions.

Current Challenges: Financial Declines and Strategic Shifts

EaseMyTrip’s financial performance in Q3 FY25 underscores its challenges. Revenue fell 6.5% year-over-year to Rs 150.5 crore, while profits dropped 26.3% to Rs 33.6 crore. EBITDA margins contracted from 37.9% to 31.7%, signaling rising operational pressures. The air ticketing segment, which generates 65% of revenue, experienced a notable decline, driven by reduced volumes and compressed margins in a market dominated by the IndiGo-Air India duopoly. Non-air segments, such as hotels (22% of revenue) and packages, showed growth but failed to offset the core business’s downturn.

Leadership transitions have added complexity. In January 2025, Nishant Pitti stepped down as CEO, selling a 1.4% stake for Rs 78 crore, with Rikant Pitti assuming leadership. Concurrently, EaseMyTrip ventured into electric bus manufacturing through Easy Green Mobility, committing Rs 200 crore over 2-3 years. This diversification into a capital-intensive, manufacturing-driven sector—far removed from its OTA expertise—introduces significant execution risks. Analysts question whether this move dilutes focus from the core travel business, especially given the company’s lack of experience in hardware production.

Another diversification effort includes a planned 150-room, 5-star hotel in Ayodhya, targeting the anticipated rise in religious tourism. While this aligns with India’s growing domestic travel demand, it requires substantial upfront investment and operational capabilities outside EaseMyTrip’s traditional strengths. The success of these ventures remains uncertain, with potential to either bolster revenue or strain resources further.

Also Promoters have started Raise Once Fund, launched in 2023, with a focus on early-stage companies in travel tech, fintech, and e-commerce. The fund typically deploys between $1 million and $5 million per investment, aiming to bolster its ecosystem or explore new opportunities. Below is a rundown of their notable investments and an analysis of whether they’re value accretive—meaning they enhance the company’s core business of booking flights, hotels, and travel services—or just financial side quests.

Investments via Raise Once Fund

TravelAI ($2 million): This startup develops AI-driven tools for personalized travel recommendations. Think of it as a digital travel agent that knows you better than your travel partner. By integrating this tech, EaseMyTrip could make its platform stickier, nudging users to book more through tailored suggestions.

PayEase ($3 million): A fintech player focused on cross-border payments, PayEase could streamline international transactions for EaseMyTrip’s globetrotting customers.

QuickCart ($1.5 million): An e-commerce logistics startup, QuickCart optimizes last-mile delivery.

Are These Investments Value Accretive?

TravelAI —its AI smarts can directly juice up EaseMyTrip’s platform, potentially boosting bookings and customer loyalty. PayEase can make international travel payments smoother, which could indirectly lift sales from overseas markets.

Competitive Positioning: EaseMyTrip vs. MakeMyTrip

Despite similar names with difference of EASEing vs MAKEing. A comparison with MakeMyTrip, India’s leading OTA, highlights EaseMyTrip’s competitive struggles. In Q3 FY25, MakeMyTrip reported a 24.8% revenue increase to $267.4 million and an 11.8% profit rise to $27.1 million. Its success stems from a strategic pivot toward hotels and holiday packages, which now surpass air ticketing as its primary revenue source. This shift capitalizes on higher margins and a fragmented hotel market, allowing MakeMyTrip to diversify its income streams effectively.

EaseMyTrip, by contrast, remains heavily reliant on air ticketing, a segment facing structural challenges. While its hotel business grew to 22% of revenue, it lags MakeMyTrip’s scale and penetration. MakeMyTrip’s gross bookings grew 23%-25% year-over-year, driven by international travel and premium offerings, whereas EaseMyTrip’s bookings stagnated, reflecting its slower adaptation to evolving consumer preferences. MakeMyTrip’s investments in technology, such as AI-driven personalization, further widen the gap, enhancing customer retention and upselling opportunities—areas where EaseMyTrip appears less advanced.

Financially, MakeMyTrip’s operating leverage and diversified portfolio provide resilience, while EaseMyTrip’s profitability, once a standout feature, has eroded. This disparity underscores the need for EaseMyTrip to rethink its revenue mix and bolster its technological capabilities to remain competitive.

The Indian OTA Market: Opportunities and Constraints

The Indian OTA market, valued at approximately $15 billion in 2025, is undergoing a structural transformation. Air ticketing, historically the backbone of OTAs, faces diminishing returns due to the IndiGo-Air India duopoly, which controls over 90% of domestic capacity. This concentration limits OTAs’ bargaining power, squeezing commissions and margins. In Q3 FY25, airfares rose 8%-10% year-over-year, yet OTA profitability in this segment declined, reflecting the airlines’ dominance.

Conversely, the hotel and homestay market, estimated at $5 billion within the OTA ecosystem, remains fragmented, with over 100,000 properties yet to be fully digitized. This presents a high-margin opportunity, as hotels offer commissions of 15%-20% compared to air ticketing’s 3%-5%. Global players like Booking.com and Expedia have aggressively targeted this segment, aggregating inventory and leveraging data analytics to capture demand. MakeMyTrip has followed suit, growing its hotel listings by 18% in 2025, while EaseMyTrip’s hotel segment, though expanding, remains underdeveloped at 22% of revenue.

Rising disposable incomes and a projected 15% annual growth in domestic tourism through 2030 fuel OTA demand, but competition is intensifying. Smaller players and niche platforms, such as Yatra and Cleartrip, further fragment the market, pressuring margins across the board. For EaseMyTrip, the OTA landscape demands a sharper focus on non-air segments to sustain growth.

Strategic Outlook: Where from here

Without course correction or adaption, EaseMyTrip could see its market share erode to 7%-8% by 2027, as competitors capitalize on hotels and premium travel. Revenue might stagnate at Rs 600-650 crore annually, with profits falling below Rs 100 crore. Statements made in previous earnings call of reaching 250 cr Net Profit has not been achieved and this has made investor segment more negative.

EaseMyTrip stands at a crossroads with several potential steps that need to be taken:

Core Business Refinement: Doubling down on hotels and packages could diversify the company's revenue and improve its margins. To expand its hotel share from 22% to 40% within three years, the company would need to aggressively increase its hotel inventory and invest heavily in marketing. However, this could stabilize its earnings. Additionally, there should be a sustained push to become the preferred rail and bus aggregator.

International Expansion: EaseMyTrip is trying to expand in the Middle East, leveraging the region’s booming travel industry and growing demand for seamless booking experiences. The company’s Dubai office has emerged as a key growth driver, contributing ₹1,704.8 million in Gross Booking Revenue (GBR) in Q3 FY25, accounting for approximately 7.93% of the total GBR. This impressive 226.9% year-on-year growth highlights the strong potential of the Middle Eastern market for EaseMyTrip. On similar lines they should also see if South East Asia expansion makes sense

EV Bus Venture: Success in electric bus manufacturing could position EaseMyTrip as a green mobility player, accessing India’s $10 billion electric vehicle (EV) market by 2030. However, with no manufacturing expertise and a commitment of Rs 200 crore, failure could lead to financial strain and reputational damage. Break-even might take 5–7 years, contingent on competitive pricing and government subsidies. This venture should only be doubled down on if EaseMyTrip can establish some differentiation. It is difficult to develop a superior product compared to established competitors like Ashok Leyland, Tata, and JBM Auto.

Startup Fund: The focus should be on funding or mentoring startups that can enhance EaseMyTrip's services and customer experience, while avoiding ventures that don’t align with or benefit the core travel business."

The company’s ability to execute these strategies hinges on operational discipline and capital allocation. Its cash reserves—Rs 300 crore as of Q3 FY25—provide flexibility, but recent diversification efforts suggest a scattershot approach that could dilute focus.

EaseMyTrip’s evolution from a bootstrapped startup to a top OTA reflects its early strategic acumen. Yet, its current challenges—financial declines, competitive lag, and untested ventures—demand a recalibration. Whether it can pivot effectively will determine its place in India’s dynamic travel market over the next decade.

I want to end on a note I’ll explore in a later article: it seems the founders want to do more than just run an OTA now. They’re planning to sell or pledge shares to fund new ventures. Their intellectual curiosity is pushing them to tackle problems in areas like airlines, electric vehicles, tourism, AI, and logistics. It feels like they’re chasing several moonshots, which reminds me of Google’s Larry and Sergey. Those guys pursued wild ideas too, but only after search became a monopoly and a huge cashflow generator. The takeaway? The founders need to first ensure their core OTA business is generating cash and growing strong. Then, they can use that cash to chase their bold new ideas.