I have been tracking Narayana Health closely for the past three years, and its new insurance venture presents an intriguing business model focused on integrated care.

As health insurance premiums have surged significantly in recent years, the Aditi insurance plan aims to address the needs of the 'missing middle' segment.

Background and Entry:

Narayana Health Insurance Ltd(company) is a new entrant (launched in 2024) in the health insurance arena, backed by Narayana Health – one of India’s largest hospital chains founded by Dr. Devi Shetty. IRDAI granted Narayana a certificate of registration in December 2023, making it the 6th stand-alone health insurer in India. This move comes after a long gap (no new health insurer had been licensed in 5 years). Narayana Health’s foray into insurance is a vertical integration strategy aimed at leveraging its hospital network to offer affordable insurance to patients. Although the company is very new, it is expected to scale by tapping the trust and patient base of Narayana Health’s 20+ hospitals across the country.

Product and Value Proposition:

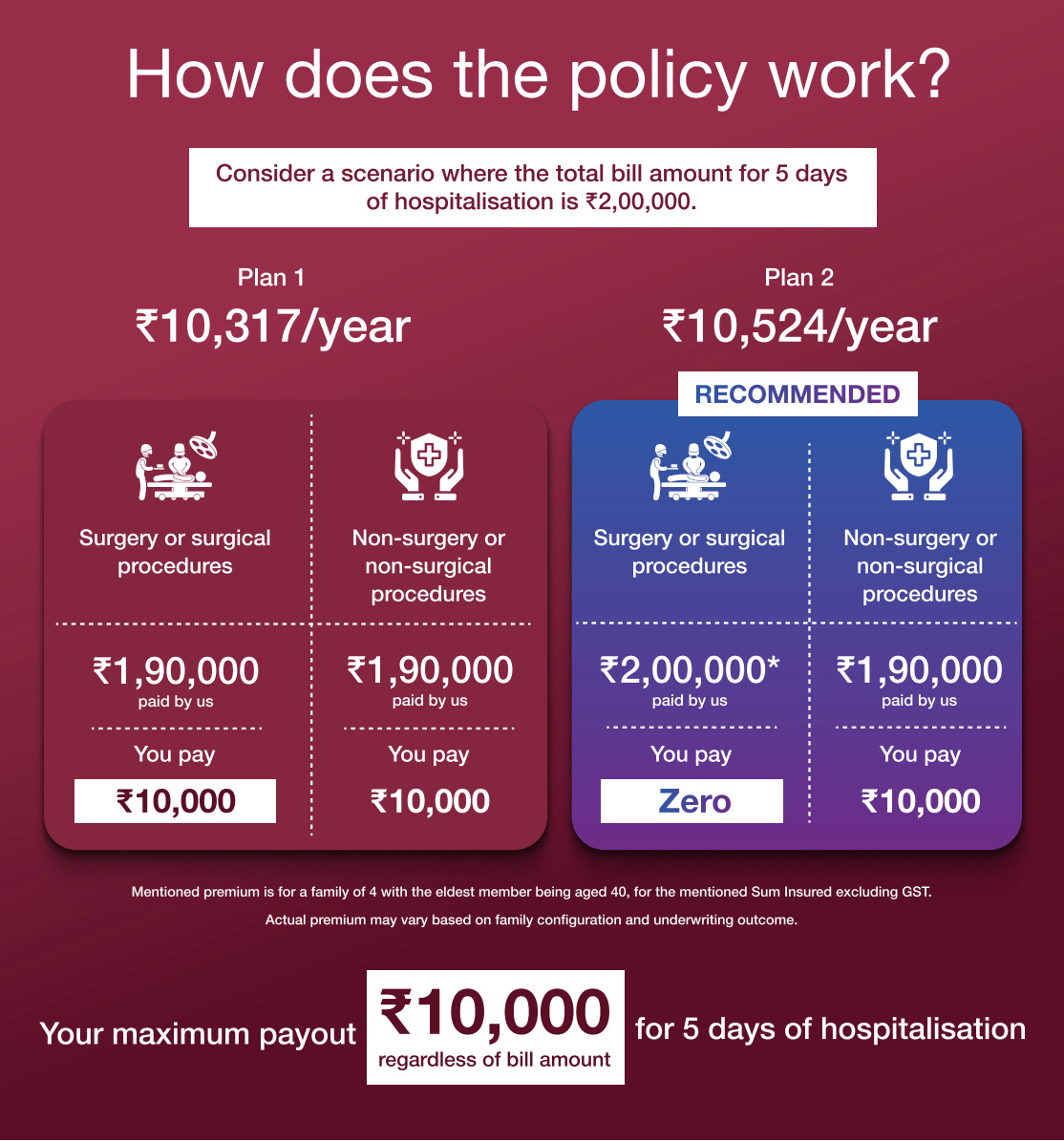

Narayana Health Insurance’s flagship offering is the “Narayana Aditi” health insurance plan(product), launched in late 2024. This product is positioned as a unique, affordable solution combining insurance coverage with guaranteed care at Narayana Health hospitals. It provides up to ₹1 crore sum insured for surgeries and ₹5 lakh for non-surgical hospitalization, but only within Narayana’s own network hospitals. By restricting to its network, Narayana is able to price the plan very competitively – roughly ₹10,000–₹11,000 annual premium for a family of four (about ₹29 per day). This is significantly lower than market rates for comparable coverage, due to expected cost efficiencies in their integrated model. The Narayana Aditi plan is targeted at the “missing middle” segment – families who are not below poverty line (and thus not covered by government schemes like Ayushman Bharat) but still find most private insurance unaffordable.

Small business owners, lower middle class are the focus, with the aim of covering those who often forego surgeries for financial reasons. The product uniquely bundles surgical benefits with insurance – essentially guaranteeing that costly surgeries (like heart bypass, oncology, etc.) at Narayana hospitals will be covered up to ₹1 crore, giving peace of mind to low-income customers. This addresses a key pain point: as Narayana’s campaign notes, only 28% of needed surgeries in India are currently performed due to financial constraints. By assuring surgical cost coverage, Narayana’s model could stimulate higher utilization of necessary treatments.

Innovations and Strategy:

Narayana Health Insurance is leveraging its parent’s strengths to differentiate. The integrated payer-provider model means Narayana can control healthcare costs better and pass on the savings. For example, they know the exact cost of procedures in their hospitals, enabling accurate pricing of premiums. The plan also removes third-party admin hurdles – since Narayana is both provider and insurer, claims are processed seamlessly in-house, leading to quicker approvals and discharges. They are marketing their insurance plan in Karnataka with a regional appeal.

Case Study of their marketing campaign in Karnataka -

The “Aditi” campaign highlights going from “Ayyo” (distress) to “Oh!” (relief) when patients realize their bills are covered. This marketing approach uses humor and local language appeals (Kannada term “Ayyo”) to connect with regional audiences, initially in Karnataka where Narayana’s presence is strong.

Distribution-wise, Narayana is likely to capitalize on its hospital touchpoints – every patient visiting a Narayana hospital is a potential insurance customer. Hospital staff can directly educate and enroll patients into the Aditi plan for future coverage. We can expect tie-ups with microfinance institutions or community groups to reach target demographics as well. While Narayana’s current geographic reach is tied to its hospital locations (the plan at launch is available in Bengaluru and Mysuru), as the hospital network grows or through strategic partners, the insurer can expand regionally.

In terms of partnerships, Narayana Health Insurance may collaborate with state governments or employers for group schemes, given its mission of affordable coverage. It’s also possible they will introduce disease-specific covers aligned with Narayana Health’s specialties (for example, a cardiac care insurance leveraging Narayana’s famed cardiac centers).

Pros and Cons of Aditi Insurance

Pros

Affordable Premiums: ₹10,000 for ₹1 crore surgical coverage is highly competitive, making it accessible to the middle and working classes.

High Surgical Coverage: The ₹1 crore limit for surgeries addresses a critical gap in India, where 50 million of the 70 million needed surgeries annually go unperformed due to cost, according to Dr. Devi Shetty.

No Waiting Period: Immediate coverage, even for pre-existing conditions, removes a common barrier in traditional plans.

Streamlined Claims: Integration within Narayana’s network ensures a hassle-free claim process, reducing delays and disputes.

Preventive Care Focus: Free checkups and teleconsultation promote proactive health management, potentially lowering long-term costs.

Cons

Restricted Network: Coverage is limited to Narayana’s 21 hospitals, which may inconvenience policyholders in areas without nearby facilities (e.g., tier-2 cities or rural regions).

General Ward Limitation: Treatment is confined to general wards, which may not appeal to middle-class families expecting higher comfort levels. You can upgrade to private room by paying extra.

Limited Medical Management Cover: The ₹5 lakh cap for non-surgical treatment is modest compared to the surgical limit and may be inadequate for chronic conditions requiring extended care.

Potential Conflict of Interest: As both provider and insurer, Narayana could prioritize cost-cutting over quality, necessitating strong governance to ensure patient care isn’t compromised.

Scalability Challenges: The model’s reliance on Narayana’s network limits its reach unless expanded significantly.

Coverage at non-network hospitals -

Coverage at non-network hospitals is only available in case of emergency and in special cases so will not go in detail.

Conclusion

Narayana Health Insurance’s entry is an innovation in offering low-cost, network-based insurance. Aditi Insurance represents a bold experiment in India’s healthcare landscape, blending affordability with high surgical coverage through Narayana Health’s integrated care model. Its success will hinge on scaling beyond Narayana’s patient base while maintaining low premiums. Scaling it will require strategic expansion, technological innovation, and possibly partnerships, all while maintaining quality and trust. If successful, it could become a model for hospital-driven insurance provision aimed at increasing healthcare access for lower-income populations.

Learnings

Health insurance is a rapidly changing field, expect lot of new innovations and business models here.

Expect other hospital chains Apollo, Max and Fortis to work on insurance especially in managed care approach

This insurance is not competing with other insurance in the market but trying to increase the pie by enhancing number of surgeries. How they manage capacity utilisation of surgical theaters in this will be interesting.

Most insurance companies earn money by investing money collected at start of the year and earning return on it. How will Narayana’s low premium strategy evolve in profit making will become clear in due time.

Website - https://www.narayanahealth.insurance/

Policy Document - Narayana-Aditi-Brochure.pdf

Very informative detailed study