I so wanted to call Nazara Technologies a GEIT( Game Estate Investment Trust) after studying acquisitions and investments Nazara is making in games but on deeper look it becomes quite apparent they are trying to morph gaming, elearning, esports, hybrid gaming, content into one diversified play.

Nazara Technologies has evolved from a mobile gaming startup into a diversified digital platform, spanning gaming, esports, elearning, and adtech. Since its founding in 2000 and its milestone IPO in 2021—the first for an Indian gaming company—Nazara has pursued a clear strategy: acquire established businesses, build synergies across divisions, and adapt to India’s growing digital market. This blog breaks down Nazara’s business model, its key moves, and what lies ahead, offering an analytical look at its strengths, challenges, and market position.

From Gaming Startup to Aggregator Model

Nazara’s early days focused on mobile value-added services like ringtones before shifting to gaming. Post-IPO, it pivoted from developing original games to an aggregator model, prioritizing acquisitions over in-house creation. Building hit games is costly and unpredictable; acquiring proven businesses offers faster access to revenue and users.

Notable acquisitions include:

Sportskeeda (2019): A sports and gaming media platform.

Kiddopia (2019): A gamified elearning app for kids.

Datawrkz (2021): An adtech firm for targeted advertising.

Fusebox Games (2024): A mobile gaming studio with narrative titles.

This shift has fueled growth by leveraging existing assets rather than betting on untested ideas. It’s a practical move for a market like India, where user acquisition costs are low but monetization remains tricky.

The Nazara we know right now is made on the acquisitions it has done. Most of the companies they have acquired can be characterised in three verticals - esports, gaming(including elearning) and adtech.

*At the end of blog I have mentioned all acquisitions and milestones of the company

The Three Pillars Driving Synergy

Nazara’s operations rest on three interconnected divisions:

Esports (including NODWIN Gaming and sportskeeda)

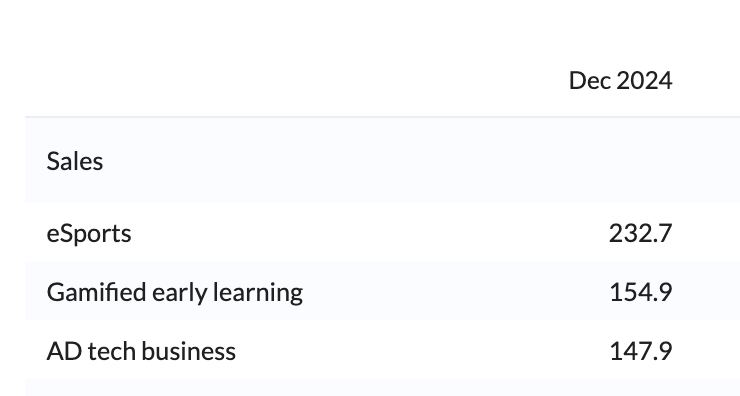

Through events and tournaments, NODWIN attracts a large audience. Acquisitions like Trinity Gaming (influencer management) and StarLadder (event production) bolster its reach. This division pulls users into Nazara’s ecosystem.Last quarter results - NODWIN’s INR 232.7 Cr Q3 revenue (48% like-for-like growth) reflects Playground S4’s 32M viewers and new markets like Uzbekistan. Acquisitions—Trinity (INR 24 Cr), AFK (INR 7.6 Cr), StarLadder (USD 5.5M)—bolster its global stack.

Acquiring Sportskeeda for ₹44 crore gave Nazara a powerful sports and esports media platform. With its extensive coverage and global user base, Sportskeeda complements Nazara’s esports business (via Nodwin Gaming) by building communities and boosting user engagement. This acquisition turned Nazara into a content-driven player, amplifying its gaming ecosystem.

Gaming (pokerbaazi and Kiddopia)

The gaming segment as a whole, which includes Kiddopia alongside other properties like Animal Jam and Fusebox Games, saw its revenue grow by 53% YoY to INR 154.9 crore.Special mention goes to elearning(Kiddopia) segment. Kiddopia offers educational games for children, using IPs like Barbie to boost engagement. It’s built for retention, targeting families with consistent, long-term content.

The ₹83.5 crore acquisition of Kiddopia marked Nazara’s entry into edutainment. By blending gaming with early childhood education, Kiddopia tapped into the rising demand for digital learning tools—a shift accelerated by the pandemic. This move diversified Nazara’s portfolio and positioned it to capture a new audience: parents and educators.

Adtech (Datawrkz)

Datawrkz hit INR 147.9 Cr, with a GBP 4.8M Space & Time buy and 38% standalone growth (14.1% margin), monetizing Nazara’s user base.

Datawrkz analyzes user behavior from esports and elearning to power targeted ads. It’s the monetization engine, turning engagement into revenue.The ₹124 crore acquisition of Datawrkz brought adtech into Nazara’s fold. Specializing in targeted advertising, Datawrkz monetizes Nazara’s growing user base across gaming, esports, and media platforms. It’s the engine that turns user attention into revenue, tying the ecosystem together.

These pillars aren’t standalone—they feed into each other. Esports brings in users, elearning keeps them engaged, and adtech cashes in on the data. It’s a smart setup, but its success depends on tight coordination and India’s willingness to spend on digital content.

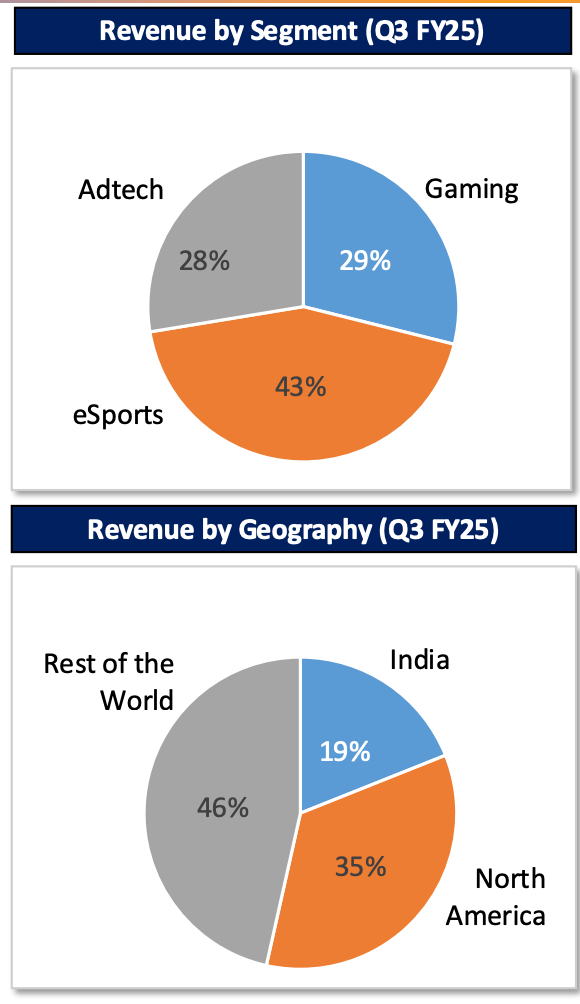

This is the revenue division between three segments of nazara technologies in last quarter(Q3FY25)

Hybrid Gaming: A Bold Expansion

In 2025, Nazara took a 60% stake in Funky Monkeys, a chain of indoor play centers, stepping into hybrid gaming. The goal? Blend digital IPs like Kiddopia with physical experiences to tap into family entertainment demand. It’s a chance to stand out in a crowded digital space, but it’s not without hurdles. Running physical locations means dealing with staffing, leases, and logistics—areas outside Nazara’s digital comfort zone. If executed well, this could be a differentiator; if not, it risks stretching resources thin.

Ownership Shifts: A New Dynamic

Nazara’s ownership structure has changed recently. Plutus and Axana Estates LLP now hold over 25%, making them promoters under Indian law, while founder Nitish Mittersain’s stake has dropped to around 8%. Promoters in India often steer strategy, raising a critical question: will these new players align with Mittersain’s vision of long-term growth, or push for quicker returns, like selling off assets? This shift could either stabilize Nazara’s ambitions or disrupt its focus, depending on how priorities align.

How Nazara Stacks Up Globally

Nazara’s approach invites comparisons to one global player although Nazara dwarfs in size to Tencent:

Tencent Games(China)

Like Nazara, Tencent grows through acquisitions (e.g., Riot Games, Supercell among others). But China’s market is bigger and more uniform, with higher user spending. India’s lower revenue per user and diverse languages make Nazara’s scaling tougher.

Nazara’s strategy is solid, but India’s unique market—price-sensitive and fragmented—means it can’t just copy out of India models. Adaptation is key.

Opportunities and Challenges Ahead

Opportunities

Market Potential: India’s gaming market could hit $8 billion by 2028, growing 28-30% annually.

Acquisitions: Buying proven businesses cuts the risk of game development flops.

Hybrid Play: Merging digital and physical could carve out a niche.

Challenges

Execution: Juggling esports, elearning, adtech, and play centers demands precision.

Monetization: Indian users spend less than Western peers, putting pressure on adtech to deliver.

Competition: Tencent and local rivals like Dream11 have deeper pockets.

Ownership Risks: New promoters could shift focus away from long-term goals.

The Bottom Line

Nazara Technologies is carving a strong position in India’s digital economy with an aggregator model that prioritizes synergy and smart acquisitions. Its push into hybrid gaming and evolving ownership add complexity but also opportunity. Things to watch out is how they play their monetization strategy.

Nazara’s strategy is both ambitious and fraught with execution risks. It is a classic tale of transformation—where growth through acquisitions must be balanced against the challenges of integration and the potential dilution of founding vision. While the company’s diversified portfolio offers a robust hedge against market volatility, the pressures of aligning disparate business models under a single strategic umbrella cannot be underestimated.

Buying assets using cashbook will increase revenue what as investors we have to track is Gross profit and EBITDA increase. That will define long term story of Nazara.

Postscript

Timeline of Key Events: A Roadmap to Reinvention

Nazara’s transformation is best seen through its milestones. Here’s a timeline of pivotal moments that chart its shift from a gaming portal to a multifaceted digital player:

2002: Pivots to mobile VAS for telecoms, moving beyond its original gaming portal roots as the dot-com dust settles.

Early 2000s: Secures deals with Archie Comics, Sachin Tendulkar, and Cartoon Network, tapping into India’s growing mobile audience.

2015: Licenses Chhota Bheem, a hit Indian animated series, for mobile games—doubling down on local appeal.

2016: Partners with Amar Chitra Katha to develop Tinkle-based games, reinforcing cultural resonance.

2017: Rakesh Jhunjhunwala invests, marking a new era of ambition and scale.

2019:

Acquires 67% of Sportskeeda, a sports and esports media platform, for ₹44 crore.

Buys 51% of Paper Boat Apps, creator of Kiddopia (a gamified elearning app), for ₹83.5 crore.

2021:

IPO: Lists as India’s first public gaming firm, raising capital and visibility.

Acquires 55% of Datawrkz, an adtech company, for ₹124 crore.

Buys OpenPlay, a real-money gaming firm, for ₹186 crore (later de-emphasized).

2022:

Takes a majority stake in WildWorks, a U.S. kids’ gaming company, for $10.4 million.

Acquires 69.82% of Publishme, a MENA-focused gaming publisher, for $2.7 million.

2023: Joins the All India Gaming Federation as a principal member, signaling intent to shape India’s gaming ecosystem.

2024:

Acquires Comic Con India via Nodwin Gaming for ₹55 crore, expanding into pop culture events.

Announces the $27.2 million acquisition of Fusebox Games, a UK studio known for narrative mobile titles.

2025:

January 2025: Buys CATS/King of Thieves ($7.7M), StarLadder ($5.5M).

February 2025: Raises INR 495 Cr; acquires Funky Monkeys (₹43.7 Cr, 60%).