What if the key to investing success isn’t just about what you buy, but how you think about what you pay relative to its true worth? This question lies at the heart of Nick Sleep’s investment philosophy, particularly his use of the cost-to-value ratio. While many investors fixate on market prices, Sleep—a legendary investor known for his concentrated, long-term bets on companies like Amazon, Costco, and Walmart—focused on a different metric: one that compares the cost of an investment to its intrinsic value. In doing so, he delivered extraordinary returns by seeing what others missed.

I have been reading Nick Sleep’s annual shareholder letters of Nomad Partnership which I encourage everyone to read, one ratio that I read Cost-to-Value has really stayed with me so I thought I will write about it and also see how it can be applied to my portfolio and also to evaluate companies. Nick Sleep particularly wanted his Cost-to-Value ratio to be near 0.5 .

I also do feel that actively managed mutual funds should publish this ratio as this will help people understand mutual fund’s prospective margin of safety. .

What is the Cost-to-Value Ratio?

The cost-to-value ratio is elegantly simple: it measures the price you pay for a stock (the cost) against your estimate of its intrinsic value. Intrinsic value,is the present value of a company’s future cash flows—what a rational investor would pay for the business with perfect foresight. The ratio is calculated as:

A ratio below 1 means you’ve bought the stock at a discount to its intrinsic value, offering a cushion against uncertainty.

A ratio above 1 indicates you’ve paid a premium, increasing your risk if your assumptions falter.

What sets Sleep apart isn’t just using this ratio at the point of purchase—it’s how he tracked its evolution. He targeted companies where the ratio would decrease over time as intrinsic value grew faster than the cost he paid. This dynamic signaled compounding value and a widening safety net, even if the market was slow to catch up.

Seeing It in Action: A Hypothetical Example

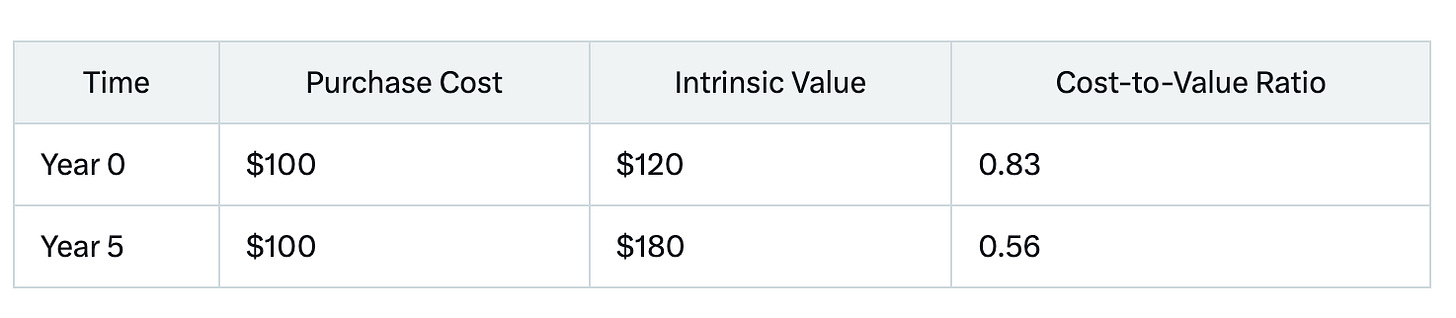

Let’s ground this with a simple example. Imagine you buy a stock for $100, and your estimate of its intrinsic value is $120, yielding a cost-to-value ratio of 0.83. Over five years, the company executes well, and its intrinsic value rises to $180, while your cost stays fixed at $100. The ratio drops to 0.56, reflecting a safer, more valuable investment.

Here’s how it plays out:

This decreasing ratio validates your thesis: the business is compounding intrinsic value, making your initial investment look smarter with each passing year.

Nick Sleep’s Real-World Wins

Sleep applied this lens to iconic investments like Amazon, Costco, and others. Let’s see how:

Amazon: When Sleep invested, skeptics saw a profitless retailer burning cash on growth. Sleep saw a company poised to dominate e-commerce because of its scale economies shared model. Buying at a cost below his intrinsic value estimate, he watched as Amazon’s AWS and marketplace scaled, driving intrinsic value skyward and shrinking the cost-to-value ratio over time.

Costco: Sleep admired Costco’s membership-driven, customer-first model. Purchased at a favorable ratio, as everyone was concerned with lower margins, its intrinsic value grew through global expansion and unshakable loyalty, steadily lowering the ratio and rewarding his patience.

In each case, Sleep’s focus wasn’t on daily price swings but on the underlying growth in intrinsic value—a hallmark of his disciplined, long-term approach.

The Margin of Safety Connection

The cost-to-value ratio dovetails with a cornerstone of investing: the margin of safety. Margin of safety is a buffer against misjudgments or market shocks. A ratio below 1 naturally embeds this margin—paying less than intrinsic value means you’re protected if your estimate is off or if conditions sour.

As intrinsic value grows and the ratio falls, this buffer widens. Sleep’s strategy exploited this dynamic, turning time into an ally rather than a risk.

Debunking the Market Price Myth

Too many investors confuse market price with value—a trap Mauboussin warns against in his work on expectations investing. Prices reflect crowd sentiment, not necessarily a company’s worth. A stock trading at $50 might be a bargain if its intrinsic value is $75, or a disaster if it’s $25.

The cost-to-value ratio cuts through this noise. By anchoring to intrinsic value, you sidestep the herd’s euphoria or panic. Sleep’s success shows that paying attention to fundamentals—not headlines—paves the way to outsized returns.

Putting It to Work: A Practical Guide

Ready to use this in your own investing? Here’s how:

Estimate Intrinsic Value: This is the crux. Options include:

Discounted Cash Flow (DCF): Project future cash flows and discount them to today.

Comparative Multiples: Adjust P/E or EV/EBITDA for growth and quality.

Qualitative Edges: Weigh moats, management, and industry trends.

Compute the Ratio: Divide your purchase price by intrinsic value. Target a ratio below 1.

Monitor Over Time: Revisit your intrinsic value estimate periodically. A declining ratio signals success; a rising one may warrant scrutiny.

Stay Patient: Sleep’s edge came from holding stocks for years as their value compounded. Short-term volatility is just noise.

If DCF feels daunting, Mauboussin offers a shortcut: reverse-engineer the current price to uncover the market’s implied expectations. If they seem wildly optimistic or pessimistic, you’ve got a clue about mispricing.

The Bigger Picture: A Mindset Shift

Nick Sleep’s cost-to-value ratio is a timeless tool for value investors. It distills investing to its essence: buying quality businesses at prices that undervalue their potential and holding them as that potential unfolds. Its brilliance lies in its simplicity and focus—shifting attention from market hype to intrinsic worth.

For investors worldwide, whether analyzing Amazon’s growth, Costco’s consistency, or Indian giants like HDFC Bank, this ratio offers clarity. It fosters discipline, rewards patience, and guards against emotional decisions. By integrating it into your portfolio, you can better navigate uncertainty, identify opportunities, and build wealth over the long haul.

In a market fixated on daily prices, the cost-to-value ratio is a reminder: true success comes from understanding value, not chasing trends. Nick Sleep’s legacy proves it works—now it’s your turn to apply it.

Interesting!